Table Of Content

This payment should be no more than 25% of your monthly take-home pay. That leaves plenty of room in your budget to achieve other goals, like saving for retirement or putting money aside for your kid’s college fund. PMI is calculated as a percentage of your original loan amount and can range from 0.3% to 1.5% depending on your down payment and credit score.

Conventional loan (conforming loan)

Most lenders are required to max DTI ratios at 43%, not including government-backed loan programs. But if you know you can afford it and want a higher debt load, some loan programs — known as nonqualifying or “non-QM” loans — allow higher DTI ratios. A down payment of 20% or more will get you the best interest rates and the most loan options.

What’s a homeowners insurance premium?

Most lenders allow you to pay for your yearly property taxes when you make your monthly mortgage payment. Your estimated yearly payment is broken down into a monthly amount, which is stored in an escrow account. Your lender then pays your taxes on your behalf at the end of the year.

Evaluate affordability

Your mortgage lender may offer you a lower interest rate if you make a larger down payment. This is because a larger down payment means you’re less likely to default on your loan. Of course, a 20% down payment is financially out of reach for many people. Fortunately, you can still get a conventional loan with a down payment as low as 3%.

What does your mortgage payment include?

Down Payment on a House: How Much Do You Really Need? - NerdWallet

Down Payment on a House: How Much Do You Really Need?.

Posted: Fri, 12 Apr 2024 07:00:00 GMT [source]

In general, you may qualify for a better interest rate with a higher down payment, which reduces the overall cost of your mortgage over time. Even a .25% reduction in your interest rate could save you thousands of dollars over the life of your loan. They must be expenses that are deducted as business expenses if incurred by an existing active business and must be incurred before the active business begins. According to IRS guidelines, initial startup costs must be amortized.

How will interest rates affect your home loan?

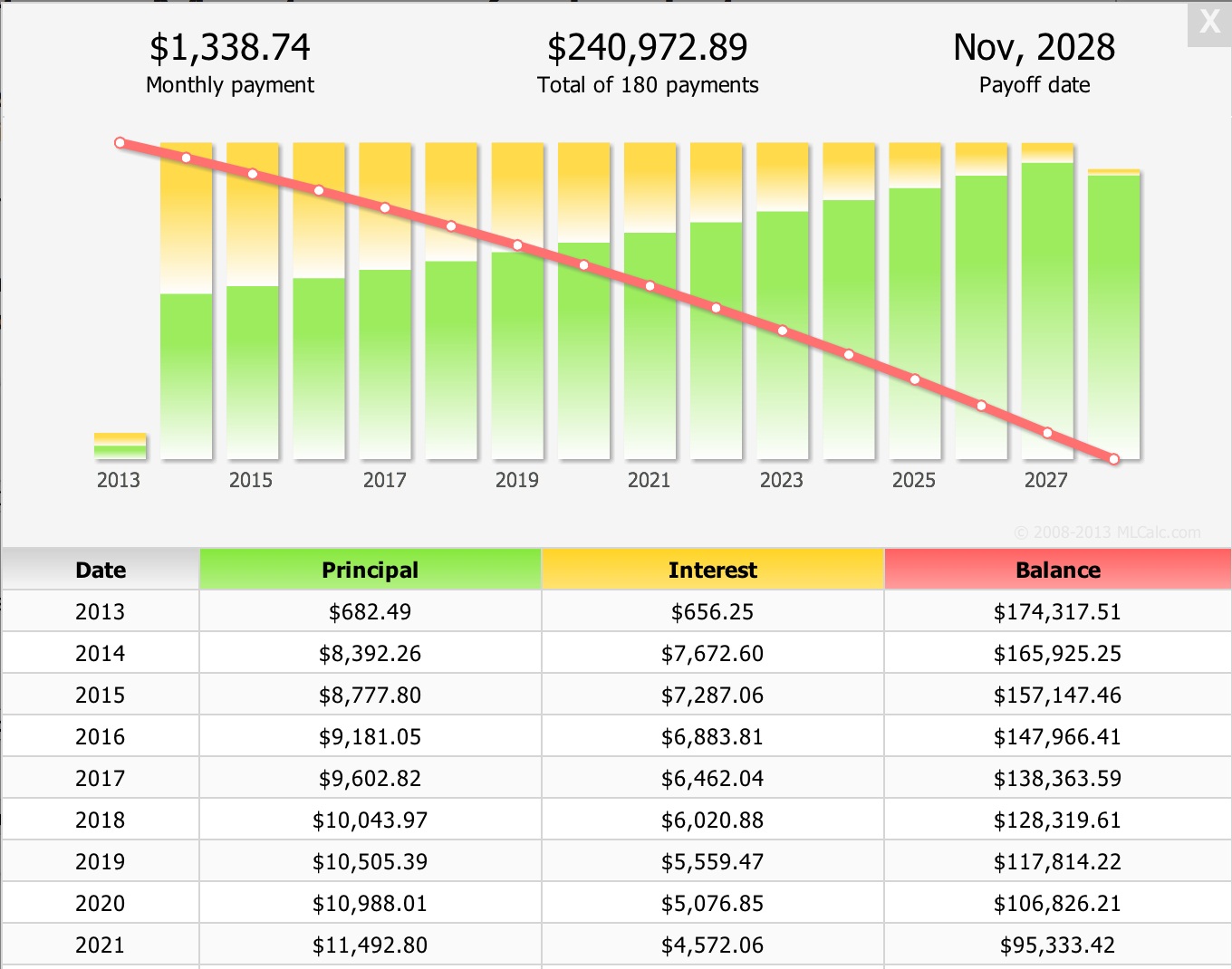

Basic amortization schedules do not account for extra payments, but this doesn't mean that borrowers can't pay extra towards their loans. Generally, amortization schedules only work for fixed-rate loans and not adjustable-rate mortgages, variable rate loans, or lines of credit. Using an online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information.

Long-term mortgages typically have higher rates but offer more protection against rising interest rates. Penalties for breaking a long-term mortgage can be higher for this type of term. To get the best mortgage interest rates and terms, you’ll want a down payment amounting to 20% of a home’s sale price. But if you don’t have 20%, you can put down as little as 3.5%, or in some cases 0%.

Explore more mortgage calculators

With house prices at already extortionate levels, now mortgage rates rising again, is there any hope for first-time buyers? Honestly, the situation is so bleak, people may need to consider other countries. Coming up with a down payment can be the hardest part of buying a home—particularly for first-time buyers. Though it makes financial sense to go with a down payment of at least 20%, it’s not always possible to save that much once you realize you’re ready to buy a house and need a place to live. The second is used in the context of business accounting and is the act of spreading the cost of an expensive and long-lived item over many periods. Compound interest is interest that is earned not only on the initial principal but also on accumulated interest from previous periods.

Unlike the first calculation, which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity. Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans, or click the links for more detail on each. The above steps calculate monthly amortization for the first month out of the 360 months in a typical 30-year loan. For the remaining months, repeat steps two through four using the previous outstanding loan balance as the new loan amount for the next month in the schedule. Ask your lender to apply the added payments to your principal.

This ratio helps your lender understand your financial capacity to pay your mortgage each month. The higher the ratio, the less likely it is that you can afford the mortgage. In exchange for giving you a loan, your lender will charge you interest on the total amount you borrow. For instance, a 4% interest rate means you’ll pay 4% on the total loan balance until the mortgage is paid off. If you’re new to homeownership, you may not realize that the loan amount isn’t the only factor to consider when determining how to calculate a mortgage payment. Let’s look at how mortgage payment calculators break down your monthly mortgage expenses.

Each repayment for an amortized loan will contain both an interest payment and payment towards the principal balance, which varies for each pay period. When a borrower takes out a mortgage, car loan, or personal loan, they usually make monthly payments to the lender; these are some of the most common uses of amortization. A part of the payment covers the interest due on the loan, and the remainder of the payment goes toward reducing the principal amount owed. Interest is computed on the current amount owed and thus will become progressively smaller as the principal decreases. It is possible to see this in action on the amortization table. Making extra payments toward your principal balance on your mortgage loan can help you save money on interest and pay off your loan faster.

No comments:

Post a Comment